Revenue of $1.7 million

Total Bookings of $2.5 million

Cash Balance in excess of $50 million

BURNABY, B.C. & PALO ALTO, Calif. – August 10, 2023 – D-Wave Quantum Inc., (NYSE: QBTS) (“D-Wave” or the “Company”) a leader in commercial quantum computing systems, software, and services, today announced financial results for its fiscal second quarter ended June 30, 2023.

“Our second quarter results reflect, we believe, growing enterprise commitment to and investment in practical quantum computing solutions that can address their complex operational challenges today. Our triple-digit increases in bookings and average deal size on a year-over-year basis are evidence, in our opinion, of forward-looking organizations prioritizing quantum as part of their modern tech infrastructure,” said Dr. Alan Baratz, CEO of D-Wave. “Companies and governments alike appear to be recognizing the value of today’s market-ready annealing quantum computing systems to drive business and national competitiveness. We’re helping harness the power of this transformative technology through industry-leading quantum hardware and software solutions and a consultative professional services approach that fuels application development and, increasingly, is preparing these applications for in-production scenarios that support customers’ daily operations.”

Recent Commercial / Business Highlights

- During the second quarter, signed a number of new and expanded existing customer engagements with Forbes Global 2000 companies including Interpublic Group and VINCI Energies as well as industry leaders such as Unisys Corporation.

- Worked with customers on a variety of new quantum and quantum-hybrid applications spanning media and advertising optimization, industrial construction, financial market performance predictions, transportation logistics and much more.

- Grew second quarter bookings (as defined below) by 146% on a year-over-year basis, representing the fifth consecutive quarter of year-over-year growth in bookings; bookings totaled $5.4 million in the first half of 2023, an increase of $3.7 million, or 209% over the first half of 2022.

- Increased average deal size (as defined below) per booking in the second quarter by 136% on a year-over-year basis and by 252% when comparing the first half of 2023 to the first half of 2022.

- Improved the Company’s liquidity position with a current cash balance in excess of $50 million.

Recent Technical Highlights

- Continued development of the next-generation Advantage2 quantum computing system, which recently successfully yielded 1,200-qubit prototype processors in the new higher coherence fabrication stack. Advantage2 is expected to feature 7,000 qubits, 20-way connectivity and higher coherence for increased performance.

- Introduced new enhancements to the Leap real-time quantum cloud service, including algorithmic updates to our hybrid solvers designed to drive increased performance for key customers. In addition, we are implementing organization administration changes in Leap to streamline project management for both D-Wave and our customers.

Second Quarter Fiscal 2023 Financial Highlights

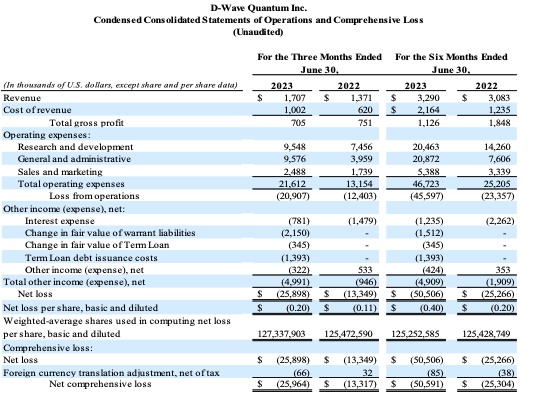

- Revenue: Revenue for the second quarter of fiscal 2023 was $1.7 million, an increase of $336,000, or 25%, from fiscal 2022 second quarter revenue of $1.4 million. Given the nature of our professional services engagements, the timing of revenue recognition associated with our professional services contracts may vary from period to period.

- Bookings1: Bookings for the second quarter of fiscal 2023 were $2.5 million, an increase of $1.5 million, or 146%, from fiscal 2022 second quarter bookings of $1.0 million. This represents D-Wave’s fifth consecutive quarter of year-over-year growth in bookings.

- Average Deal Size2: During the second quarter of fiscal 2023, D-Wave’s average deal size per booking increased by 136% when compared to the second quarter of fiscal 2022. During the same period, the average deal size per booking from commercial customers increased by 163% year over year.

- Customers: Over the last four quarters, we had 68 revenue producing commercial customers compared with 72 commercial customers in the immediately preceding four quarters with total commercial revenue increasing by 44% between the two periods and the average deal size for commercial customers increasing by 308% between the two periods. Over the last four quarters, we had a total of 115 revenue producing customers compared with 116 total customers in the immediately preceding four quarters, with total customers including commercial, educational and government accounts.

- GAAP Gross Profit: GAAP gross profit for the second quarter of fiscal 2023 was $705,000, a decrease of $46,000, or 6%, from the second quarter of fiscal 2022 GAAP gross profit of $751,000, with the decrease due primarily to higher stock-based compensation expenses in cost of sales in the second quarter of fiscal 2023.

- GAAP Gross Margin: GAAP gross margin for the second quarter of fiscal 2023 was 41.3%, a decrease of 13.5% from the 54.8% GAAP gross margin for the second quarter of fiscal 2022 with the decrease principally due to higher stock-based compensation expense in cost of sales. GAAP gross margin for the second quarter of fiscal 2023 increased by 14.7% from the 26.6% GAAP gross margin in the immediately preceding first quarter of fiscal 2023 due primarily to higher revenue and lower stock-based compensation expenses.

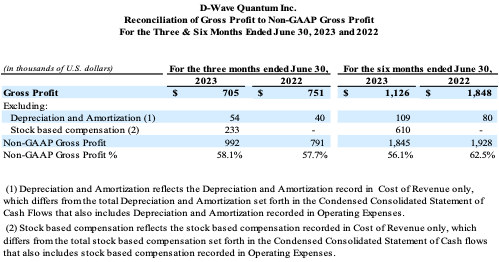

- Non-GAAP Gross Profit3: Non-GAAP gross profit for the second quarter of fiscal 2023 was $1.0 million, an increase of $201,000, or 25%, from the second quarter of fiscal 2022 non-GAAP gross profit of $791,000. The difference between GAAP and non-GAAP gross profit is limited to non-cash stock-based compensation and depreciation expenses that are excluded from the non-GAAP gross profit.

- Non-GAAP Gross Margin4: Non-GAAP gross margin for the second quarter of fiscal 2023 was 58.1%, an increase of 0.4% from the second quarter of fiscal 2022 non-GAAP gross margin of 57.7%. Non-GAAP gross margin for the second quarter of fiscal 2023 increased by 4.3% from the 53.8% non-GAAP gross margin in the immediately preceding first quarter of fiscal 2023 due primarily to higher revenue. The difference between GAAP and non-GAAP gross margin is limited to non-cash stock-based compensation and depreciation expenses that are excluded from the non-GAAP gross margin.

- GAAP Operating Expenses: GAAP operating expenses for the second quarter of fiscal 2023 were $21.6 million compared with $13.2 million in the second quarter of fiscal 2022 with the year-over-year increase including $3.7 million in non-cash stock-based compensation expense and higher public company and headcount-related expenses.

- Non-GAAP Adjusted Operating Expenses5: Non-GAAP operating expenses for the second quarter of fiscal 2023 were $15.9 million compared with $12.0 million in the year earlier fiscal 2022 second quarter with the difference between GAAP and non-GAAP operating expenses being primarily non-cash stock-based compensation expense, non-recurring one-time expenses, and depreciation.

- Net Loss: Net loss for the second quarter of fiscal 2023 was $25.9 million, or $0.20 per share, compared with a net loss of $13.3 million, or $0.11 per share, in the second quarter of fiscal 2022.

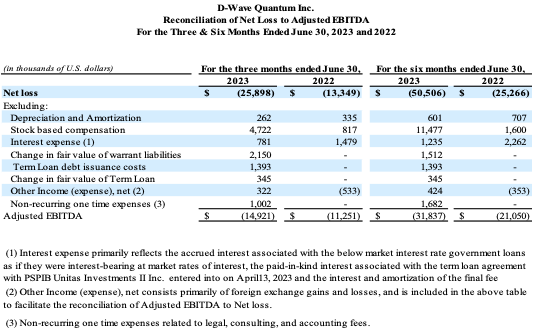

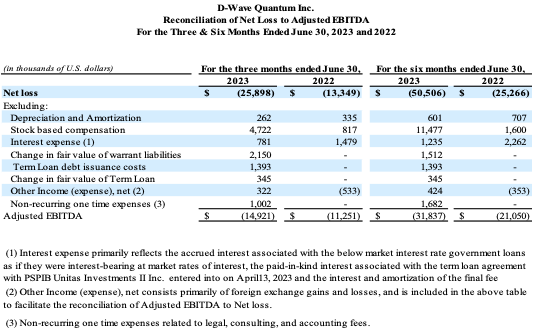

- Adjusted EBITDA6: Adjusted EBITDA for the second quarter of fiscal 2023 was negative $14.9 million, compared with a negative $11.3 million in the fiscal 2022 second quarter and an improvement over the negative $16.9 million in the immediately preceding first quarter of fiscal 2023 with the year-over-year increase due primarily to higher public company and headcount-related expenses.

Financial Results for the First Half of Fiscal Year 2023

- Revenue: Revenue for the six months ended June 30, 2023, was $3.3 million, an increase of $207,000, or 7%, from revenue of $3.1 million in the six months ended June 30, 2022.

- Bookings1: Bookings for the six months ended June 30, 2023, were $5.4 million, an increase of $3.7 million, or 209%, from bookings in the six months ended June 30, 2022.

- Average Deal Size2: During the six months ended June 30, 2023, D-Wave’s average deal size per booking increased by 252% when compared to the six months ended June 30, 2022. During the same period, the average deal size per booking from commercial customers increased by 232% year over year.

- GAAP Gross Profit: GAAP gross profit for the six months ended June 30, 2023, was $1.1 million, a decrease of $722,000, or 39%, from $1.8 million in GAAP gross profit the six months ended June 30, 2022, with the decrease due primarily to higher stock-based compensation expense in cost of sales in the first half of fiscal 2023.

- GAAP Gross Margin: GAAP gross margin for the six months ended June 30, 2023, was 34.2%, a decrease of 25.7% from the 59.9% GAAP gross margin in the six months ended June 30, 2022, with the decrease due primarily to higher stock-based compensation expense in cost of sales.

- Non-GAAP Gross Profit3: Non-GAAP gross profit for the six months ended June 30, 2023, was $1.8 million, a decrease of $83,000, or 4%, from the non-GAAP gross profit of $1.9 million in the six months ended June 30, 2022. The difference between GAAP and non-GAAP gross profit is limited to non-cash stock-based compensation and depreciation expenses that are excluded from the non-GAAP gross profit.

- Non-GAAP Gross Margin4: Non-GAAP gross margin for the six months ended June 30, 2023, was 56.1%, a decrease of 6.4% from the 62.5% non-GAAP gross margin in the six months ended June 30, 2022. The difference between GAAP and non-GAAP gross margin is limited to non-cash stock-based compensationand depreciation expenses that are excluded from the non-GAAP gross margin.

- GAAP Operating Expenses: GAAP operating expenses for the six months ended June 30, 2023, were $46.7 million compared with $25.2 million in the six months ended June 30, 2022, with the year-over-year increase including $9.3 million in non-cash stock-based compensation expense and higher public company and headcount-related expenses.

- Non-GAAP Adjusted Operating Expenses5: Non-GAAP operating expenses for the six months ended June 30, 2023, were $33.7 million compared with $23.0 million in the six months ended June 30, 2022, with the difference between GAAP and non-GAAP operating expenses being primarily non-cash stock-based compensation expense, non-recurring one-time expenses, and depreciation.

- Net Loss: Net loss for the six months ended June 30, 2023, was $50.5 million, or $0.40 per share, compared with a net loss of $25.3 million, or $0.20 per share, in the six months ended June 30, 2022.

- Adjusted EBITDA6: Adjusted EBITDA for the six months ended June 30, 2023, was negative $31.8 million, compared with a negative $21.1 million in the six months ended June 30, 2022, with the increase due primarily to higher public company and headcount-related expenses.

We are providing non-GAAP financial measures including non-GAAP gross profit, non-GAAP gross margin, non-GAAP adjusted operating expenses and Adjusted EBITDA, as well as bookings and average deal size operating measures, as we believe these metrics improve investors’ ability to evaluate our underlying performance. Non-GAAP measures do not have any standardized meaning under GAAP, and therefore may not be comparable to similar measures employed by other companies.

- “Bookings” is an operating measure that is defined as customer orders received that are expected to generate net revenues in the future. We present the operational metric of bookings because it reflects customers' demand for our products and services and to assist readers in analyzing our performance in future periods.

- “Average deal size” is an operating measure that is defined as the average dollar amount per booking.

- “Non-GAAP gross profit” is a non-GAAP financial measure. For a description of non-GAAP gross profit and a reconciliation to gross profit, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release.

- “Non-GAAP gross margin” is a non-GAAP financial measure. For a description of non-GAAP gross margin and a reconciliation to gross margin, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release.

- Adjusted operating expenses is a non-GAAP financial measure. For a description of adjusted operating expenses and a reconciliation to operating expenses, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release.

- Adjusted EBITDA is a non-GAAP financial measure. For a description of Adjusted EBITDA and a reconciliation to net loss, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release.

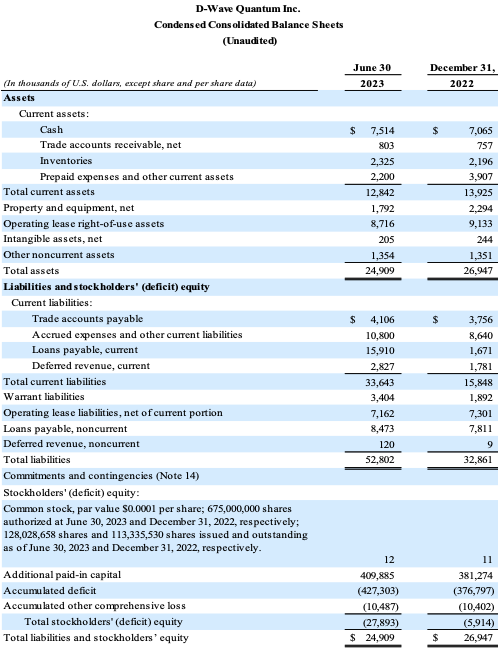

Balance Sheet and Liquidity

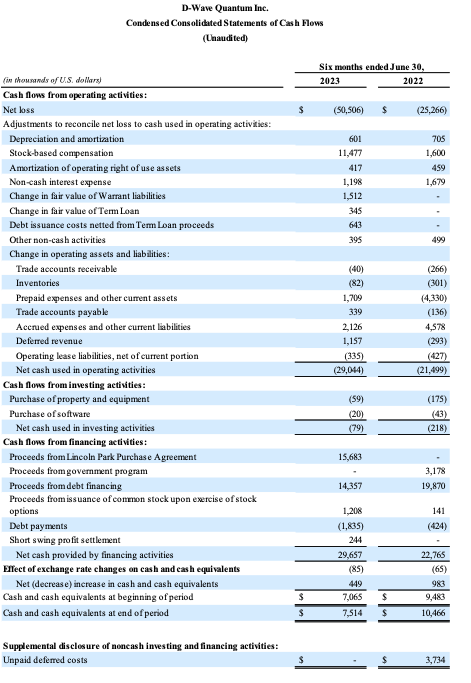

As of August 8, 2023, D-Wave’s consolidated cash balance exceeded $50 million compared to the June 30, 2023, consolidated cash balance of $7.5 million. This represents the Company’s largest cash balance in its history. On April 13, 2023, D-Wave entered into a $50 million four-year term loan agreement (the “PSP Loan”) with PSPIB Unitas Investments II Inc., an affiliate of PSP Investments. The loan agreement is comprised of three individual tranches of $15 million, $15 million, and $20 million respectively and, to date, D-Wave has drawn the first two tranches totaling $30 million. However, there can be no assurance that the Company will be able to meet the conditions necessary to draw on the third tranche.

As previously disclosed, on June 16, 2022, D-Wave entered into a common stock purchase agreement (Equity Line of Credit or “ELOC”) with Lincoln Park Capital Fund, LLC (“Lincoln Park”) wherein the Company has the right, but not the obligation, to issue and sell up to $150 million of shares of its common stock to Lincoln Park, subject to certain limitations and satisfaction of certain conditions, over a 3-year period. As of the end of the first quarter of 2023, D-Wave raised approximately $20 million through the ELOC leaving $130 million in availability with over two years remaining under the ELOC commitment. On July 24, 2023, D-Wave re-commenced its use of the ELOC and raised a total of $35.1 million through August 8, 2023. D-Wave’s ability to raise funds under the ELOC is subject to a number of conditions including having a sufficient number of registered shares and having the stock price being above $1.00 per share.

Fiscal Year 2023 Outlook

We are reiterating the full year 2023 financial guidance set forth in our July 20, 2023, preliminary second quarter revenue and bookings press release. Our guidance is subject to various cautionary factors described below. Based on the information available on August 9, 2023, guidance for the full year 2023 is as follows:

Revenue

- We expect fiscal 2023 revenue to be in a range of $11 million to $13 million.

Adjusted EBITDA

- We expect fiscal 2023 Adjusted EBITDA[3] to be less than negative $58 million.

- We are not able to reconcile guidance for Adjusted EBITDA to its most directly comparable GAAP measure, net loss, and cannot provide an estimated range of net loss for such period without unreasonable efforts because certain items that impact net loss, including foreign exchange and stock-based compensation, are not within our control or cannot be reasonably predicted.

Second Quarter 2023 Conference Call

In conjunction with this announcement, D-Wave will host a conference call on Thursday, August 10, 2023, at 8:00am (Eastern Time) to discuss such financial results and its business outlook. The live dial-in number is 1-888-999-5318 (domestic) or 1-848-280-6460 (international)

About D-Wave Quantum Inc.

D-Wave is a leader in the development and delivery of quantum computing systems, software, and services, and is the world’s first commercial supplier of quantum computers—and the only company building both annealing quantum computers and gate-model quantum computers. Our mission is to unlock the power of quantum computing today to benefit business and society. We do this by delivering customer value with practical quantum applications for problems as diverse as logistics, artificial intelligence, materials sciences, drug discovery, scheduling, cybersecurity, fault detection, and financial modeling. D-Wave’s technology is being used by some of the world’s most advanced organizations, including Volkswagen, Mastercard, Deloitte, Davidson Technologies, ArcelorMittal, Siemens Healthineers, Unisys, NEC Corporation, Pattison Food Group Ltd., DENSO, Lockheed Martin, Forschungszentrum Jülich, University of Southern California, and Los Alamos National Laboratory.

Non-GAAP Financial Measures

To supplement the financial information presented in accordance with GAAP, we use non-GAAP measures of certain components of financial performance. Each of non-GAAP gross profit, non-GAAP gross margin, Adjusted EBITDA and non-GAAP adjusted operating expenses is a financial measure that is not required by or presented in accordance with GAAP. Management believes that each measure provides investors an additional meaningful method to evaluate certain aspects of such results period over period. Non-GAAP gross profit is defined as GAAP Gross Profit less non-cash stock-based compensation expense. We use non-GAAP gross profit to measure, understand and evaluate our core operating performance and trends and to develop short-term and long-term operating plans. Non-GAAP gross margin is defined as GAAP Gross Margin less non-cash stock-based compensation expense. We use non-GAAP gross margin to measure understand and evaluate our core business performance. Adjusted EBITDA is defined as net loss before interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation, remeasurements of liability-classified warrants, and other nonrecurring nonoperating income and expenses. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations. Non-GAAP Adjusted operating expenses is defined as operating expenses before depreciation and amortization expense and stock-based compensation expense. We use non-GAAP adjusted operating expenses to measure our operating expenses, excluding items we do not believe directly reflect our core operations. The presentation of non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the financial results prepared in accordance with GAAP, and our presentation of non-GAAP measures may be different from non-GAAP measures used by other companies. For a reconciliation of non-GAAP gross profit, non-GAAP gross margin, Adjusted EBITDA and non-GAAP adjusted operating expenses to its most directly comparable GAAP measure, please refer to the reconciliations below.

Forward-Looking Statements

Certain statements in this press release are forward-looking, as defined in the Private Securities Litigation Reform Act of 1995. These statements involve risks, uncertainties, and other factors that may cause actual results to differ materially from the information expressed or implied by these forward-looking statements and may not be indicative of future results. Forward-looking statements in this press release include, but are not limited to, the expected features of Advantage2, the Company’s ability to raise funds under the ELOC, and full-year 2023 guidance. These forward-looking statements are subject to a number of risks and uncertainties, including, among others, the variability of professional service revenues; profitability of new customer contracts; D-Wave’s ability to draw on the third tranche of the PSP Loan; general economic conditions and other risks; our ability to expand our customer base and the customer adoption of our solutions; risks within D-Wave’s industry, including anticipated trends, growth rates, and challenges in those businesses and the markets in which they operate; the outcome of any legal proceedings that may be instituted against us; risks related to the performance of our business and the timing of expected business or financial milestones; unanticipated technological or project development challenges, including with respect to the cost and or timing thereof; the performance of our products; the effects of competition on our business; the risk that we will need to raise additional capital to execute our business plan, which may not be available on acceptable terms or at all; the risk that we may never achieve or sustain profitability; the risk that we are unable to secure or protect our intellectual property; volatility in the price of our securities; and the numerous other factors set forth in D-Wave’s Annual Report on Form 10-K for its fiscal year ended December 31, 2022 and other filings with the Securities and Exchange Commission. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information available to us on the date hereof. We undertake no duty to update this information unless required by law.